In yesterday's mail, we got four -- FOUR -- credit card offers from Capitol One. I do sincerely appreciate the humor of their television commercials, but I would rather put a tarantula in my wallet than a credit card.

We've been down that credit card trail twice in our marriage.

The first time, we were silly newlyweds with debt. Not a lot, but enough. We got our credit cards all paid off by the time our first anniversary rolled around. You'd think we would have learned, but naturally, we didn't. We got a couple of new credit cards and went to work.

By the time our fourth annivcrsary came around, we had a brand new house. We bought it according to the conventional wisdom of the banking and real estate industries, neither of which had our best interests at heart, as it turned out. If we'd known Dave Ramsey's financial principles at the time, we never would have bought it. He recommends that couples: 1) make sure that the mortgage payment is no more than 36% of the monthly income; 2) assume ONLY a fixed-rate fifteen year mortgage; 3) have a three-to-six month savings built up for an emergency fund; 4) have a good chunk of downpayment (I can't remember what Dave suggests, but I think it might be something like 20%).

We had none of this.

We took out a thirty year mortgage; we had a very small downpayment -- maybe 10%? -- that ate up our entire savings, and the monthly payment consumed about 38% of our income.

It confused us terribly when we moved in and immediately started experiencing financial strain. Aisling was born a month after we moved in and our little stack of credit cards helped us get our home and our new baby comfortably settled until I took on a much-loved in-home babysitting job that I kept for the next five years.

My husband's income continued to rise, so things evened out after awhile. But by that time, we were spoiled by the immediate gratification that credit cards offer. We got deeper in debt, over silly things like dinners at Applebees and non-silly things, like paying off the balance of our account at the local hospital from my gall bladder surgery after they relentlessly harrassed us by telephone three or four times a week, telling us that we had to pay much more per month than we could afford. The minimum payment on the credit card was less and it seemed like the smart thing to do.

It wasn't. We didn't realize that they were doing something illegal. If we'd known Dave's plan, we could have contacted the Federal Trade Commission, which frowns on strong arm tactics. Then we could have arranged a payment plan that we could afford and possibly even sicced a lawyer on them.

By the time we'd been married ten years, we were scared at the way our balances were building up and we decided to stop using credit cards, forever. We cut them all up and began paying down our balances and that felt really good. It was a slow process, but we were actually making headway. We were proof that life without credit cards is possible, even if you earn only a modest income. We paid for everything with cash -- Christmas gifts, birthday presents, everything. When my old portable dishwasher bit the dust, it took us three months to save up for a new one, but gosh, did it ever feel good writing that check!

Now we've been married for almost seventeen years and I haven't carried a credit card with me for seven years. I entertain a very limited respect, so small as to be one what might call "nonexistent," for the credit card industry, which is in the business of tempting people to live beyond their means, and then punishing them for giving in.

Which is why I so deeply enjoyed turning those four credit card offers into confetti yesterday. Tearing up credit card offers is such a visceral pleasure to me, I refuse to consign that duty to a shredder. Rrrrri-i-i-ip!!!! Rrri-i-i-i-i-i-i-i-ip!!! Take that, Capitol One! Take that, Bank America! TAKE THAT, CHASE MANHATTAN!!!!

Never shall you see the inside of my wallet again.

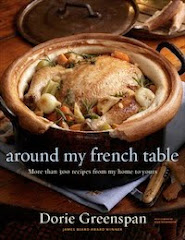

Tuesdays with Dorie: Baking with Dorie - Cranberry Spice Squares

-

The fourteenth recipe I made with the Tuesdays with Dorie: Baking with

Dorie group is Cranberry Spice Squares and can be found in the Baking with

Dorie boo...

3 years ago

1 comment:

Ah, and I, too, never use a credit card...I found that I always bought more or differently when I had that card in tow...that when I don't have it, I think before purchasing, and think what I am purchasing, etc., and realize that most of what I would have purchased is not something I need or even really and truly want...silly, isn't it? Anyway, I

I appreciate having a friend who feels likewise.

As I get older, too, I find that I am just trying to figure ways to give things away and exit this life with one tiny little box of items that the boys can toss in a few seconds...LOL. This, of course, means that they will no longer be living here and that they have taken all their scrapbooks with them...LOL.

Post a Comment