There's an article on MSN Money this morning informing readers why credit cards are a good thing. Yes, good. Like a medium-rare steak with Bearnaise or a furry little spaniel puppy or the news that researchers have discovered that you can make the calories fall out of a dozen doughnts -- any variety -- by shaking the bakery box really hard for thiry seconds.

MSN Money writer Liz Pulliam Weston relates that credit cards are "a tool, a penny-pincher and a guardian" for consumers, helping them arbitrate squabbles with merchants, pay bills online and protect themselves from identity theft. The last time I looked, you could pay bills online with a debit card just as easily as a credit card. Secondly, my debit card has a little symbol in its lower right hand corner that indicates that any purchase I make with it from my personal checking is also backed up by that issuer.

She also goes in for that big deal about how credit cards offer various "rewards." For instance, she points out that using credit cards can actually help you save money. Yes! They can! With some credit cards, every time you charge a dinner at The Cheesecake Factory or buy paint at Home Depot or whatever, the issuer will place 1-3% of your total purchase in a savings account for you, which is darned generous of them, isn't it? At that rate, after making multiple puchases every month for about ten years, you might be able to go out to dinner at The Cheesecake Factory again with that windfall of cash from your savings account!

Just don't get the idea that the money saved in this account is going to put one of your kids through college, or bartending school, or, say, a week of tennis camp at your local YMCA, and you should be just fine.

Rather disingenuously, Liz admonishes her readers: "Plastic offers an array of protections and sweet perks -- many of which cardholders don't bother to use. Just don't let the goodies tempt you to go into debt."

Thanks, Liz. Really. Thanks for that advice. And do you mind if I ask -- have you lost your mind, woman? What, exactly, do you think people in our society are doing with all their credit cards? I'll tell you, because you don't seem to know: THEY USE THEM TO GET INTO DEBT.

Often times, they don't mean to. Couples will have one credit card around "just for emergencies" and then an emergency comes along that they don't have the cash to cover and the balance goes on the credit card, which of course is too much to pay off at the end of the month because if they could pay it off at the end of the month, they likely would have paid it off when the emergency happened in the first place. Then they're stuck, paying that monthly minimum, until the next emergency comes along at ratchets up the outstanding balance just a little more.

Or maybe a lot more, depending on the emergency. Right now, with all the flooding in Indiana, gas generators, battery-powered back up sump pumps and even Shop-Vacs are selling briskly, according to a news report this morning on 93.1FM-WIBC. You think a lot of the people whose basements or living rooms are flooded with four feet of water, who had no electricity for three or four or five days all have the cash on hand to go out and buy these things? My heart aches for of them, since so many didn't have flood insurance. They were never required to have it; never dreamed they'd even need it, and now they've lost everything. Except, of course, their debt.

Frankly, I'd rather carry a rattlesnake in my wallet, Liz.

The greater percentage of people who have credit cards are not going to use them in the manner that Liz tells us they should be used: with rewards, without debt. Most people are going to carry some kind of balance over from one month to the next. That's exactly what the credit card companies are hoping they will do. The card issuers know that most people will forget about or never bother themselves to redeem their "points," their "perks," or even their frequent flyer miles. That's just fine with them.

But it shouldn't be fine for the majority of people out there, all of whom would be best advised to run like the wind from most of the conventional wisdom about finances out there. The same banks who run the credit card industry are also the same banks who are in it straight up to the neck with all the adjustable rate mortgage loans that have caused home foreclosures from sea to shining sea. I'm not completely convinced that people should be listening to much of anything they have to say.

Or to Liz. She's one of them.

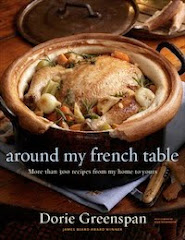

Tuesdays with Dorie: Baking with Dorie - Cranberry Spice Squares

-

The fourteenth recipe I made with the Tuesdays with Dorie: Baking with

Dorie group is Cranberry Spice Squares and can be found in the Baking with

Dorie boo...

3 years ago

1 comment:

Loud and clear on the credit card issue...I pride myself on not using those at all. That said, I am fortunate in that I don't have emergencies coming up all that often...if ever. Hate me, it is okay to just hate me. I feel bad about that aspect, too. I so don't deserve it.

Post a Comment